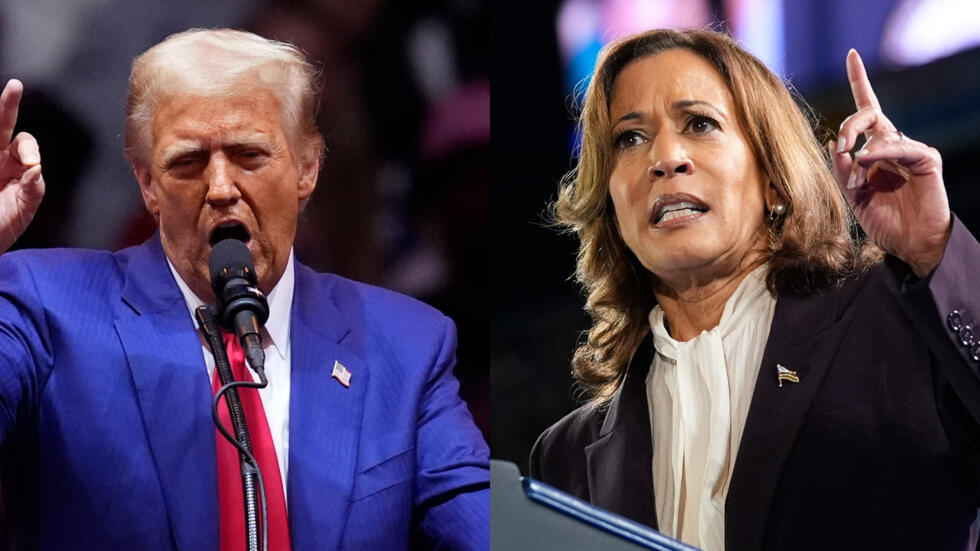

In the early hours of 6 November local time, with the counting of votes in the US election still underway, Republican presidential candidate Donald Trump took to the stage of a Florida rally to begin his speech, declaring his victory in the 2024 presidential election. According to the latest preliminary calculations of several U.S.media, Trump has obtained at least 270 electoral votes.

As an important pillar of the U.S. economy, the auto industry has been repeatedly mentioned in the election. So, what kind of changes may occur in the U.S. auto industry after Trump comes back to power? What impact might it have on China's auto industry and even the global auto industry?

Doubts about the tax increase on China

Previously, Trump mentioned Chinese cars in his rally speech in Detroit, U.S. He threatened to impose a 200% or even 1000% tariff on Chinese cars if he is elected president.

Currently, only a small number of complete vehicles from China are exported to the U.S., and the tariffs at this stage are enough to keep the vast majority of electric cars out of the U.S. gates. Just in September this year, the Biden administration announced that on the basis of the original 301 tariffs on China, further tariffs on imports from China of electric vehicles, lithium batteries, photovoltaic batteries, key minerals, semiconductors, harbour cranes, etc., of which the tariffs imposed on electric vehicles from 25% to 100%, plus 2.5% of the regular tariffs, electric vehicles exported from China to the United States will need to pay up to 102.5 per cent tariff.

From Trump's campaign views, the probability is that the next four years of his administration will continue the 2018 strategy of introducing a series of measures to restrict many Chinese-made products, including cars.

A push for internal combustion engines and a reversal of the electric car?

Undoubtedly, compared with the current President Biden and Democratic candidate Harris, Trump has always been against climate change and the development of electric vehicles ‘not cold’.

In his previous term, Trump not only on fuel efficiency and emission standards ‘water’, leading the United States to withdraw from the Paris Agreement, but also prohibited California to develop more stringent emission standards for new cars, resulting in California and the White House in court. During his tenure, the U.S. federal government level does not encourage the development of electric vehicles, only to see the development of electric vehicles in China and the European market red-hot, General Motors, Ford, represented by the U.S. car companies are worried about lagging behind, only to take the initiative to invest heavily to promote the transformation of electrification.

After Biden came to power, he pushed the development of electric vehicles, giving huge subsidies and policy support, making the United States gradually become the world's third largest electric vehicle market after China and Europe. In this process, the Inflation Reduction Act to provide huge subsidies to enterprises, as well as to provide consumers with tax rebates for the purchase of subsidies played an important role in attracting major OEMs and South Korean battery manufacturers to build factories in North America, to promote the localised production of power batteries and electric vehicles.

In contrast, Trump has been openly opposed to clean energy, wanting to repeal the Inflation Reduction Act and boost U.S. oil and natural gas production. Since the second half of last year, the U.S. electric vehicle market demand has been cooling, General Motors and Ford also slowed down the pace of transformation, if this time there is no more policy support and tilt, car companies invested in the field of electric vehicles or resources will be further reduced, so that the U.S. electric vehicle market to accelerate the cooling.

Trump previously campaigned in Michigan to stress the importance of the internal combustion engine vehicle industry, criticised Biden's electric vehicle policy, saying that it will support the manufacturing industry and bring more employment opportunities to the automotive industry. Trump has emphasised that no state should ban the production of internal combustion engine cars if he is re-elected president.

Korean manufacturers to cry?

Due to the U.S. market for Chinese-made electric vehicles and batteries artificially set high barriers, currently in North America, South Korea's three major battery manufacturers stand alone, have to spend huge sums of money, either alone or in joint ventures with the host factory to build battery factories, and to obtain a large order of batteries. For example, in August this year, Samsung SDI and General Motors announced that it will invest about $3.5 billion to build a joint battery plant in Indiana, which is expected to go into operation in 2027; in October this year, LG New Energy and Stellantis battery joint venture plant in Canada began production. In addition, SK On and Ford are also planning to build two battery plants in the United States.

By building factories in North America, South Korean manufacturers on the one hand, can be close to the battery single, on the other hand, can also enjoy the U.S. ‘Inflation Reduction Act’ provides a huge subsidy. Therefore, the Korean industry is highly concerned about the economic policies of the U.S. government after the change of administration, such as subsidies, electric vehicle policy, tariffs and so on. The Korean industry is particularly sensitive to whether the subsidies will change, if there is a reduction in the performance of the relevant Korean enterprises will inevitably be very negatively affected.

For example, in the third quarter of this year, LG New Energy's operating profit was 448.3 billion won, down 38.7 per cent year-on-year. This is still the U.S. Inflation Reduction Act subsidies provided by the results of the calculation, otherwise the quarter the company will appear nearly 18 billion won operating loss.

Previously, SK On's planned second battery plant with Ford had hit the pause button due to slowing demand in the US electric vehicle market, and LG New Energy's third battery plant in the US joint venture with General Motors was also called off. Now, with Trump winning the election, the already cooling U.S. electric car market seems to be facing further frost. KangDong-jin, an analyst at Hyundai Motor Securities, said, ‘The prevailing view is that if Trump is re-elected as U.S. president, the rate of growth in demand for electric vehicles may slow down (compared to Harris), as he has suggested cutting electric vehicle tax credits.’

Borrowing from Mexico on the road to the U.S. blocked?

Previously in order to get the Inflation Reduction Act subsidies, Volkswagen Group, Toyota, Hyundai and other European and Japanese and South Korean car companies have adjusted and upgraded production lines in North America in order to produce electric cars. If the subsidy is cancelled, for these car companies, the equivalent of the previous investment are playing the water.

More seriously affected is Mexico. For cost considerations, Volkswagen Group, BMW, Renault, Toyota, Honda, Nissan, Mazda and many other car companies to build factories in Mexico to produce cars, even the United States car companies General Motors, Ford, Stellantis, but also gradually part of the production of models to Mexico, and then through the United States-Mexico-Canada Agreement (USMCA) imported into the U.S. market. Chinese car companies BYD, Chery, etc. are also interested in taking this road.

In order to promote the return of manufacturing, Trump previously threatened, ‘If I become president of this country, I will impose a 100 per cent, 200 per cent tariff on imported cars from Mexico, and will not allow them to sell any car to the United States.’ If it comes true, then for Europe, the United States and the United States and Japan car companies, the killing force is very big, Chinese car companies borrow Mexico into the United States road will also be similarly blocked.

In addition, in order to help Trump's campaign firmly ‘stand in line’ Musk will also usher in the harvest. Musk's SpaceX and Tesla businesses rely heavily on U.S. federal government approvals, regulations, subsidies or contracts. Trump's promise to create a looser regulatory environment and his plans to lower corporate and personal taxes could have a positive impact on Musk's business operations. And if Trump further eliminates electric car subsidies in the future, it could be bad for the overall market, though. But for Tesla, a subsidy-free environment could instead help Tesla consolidate its market leadership due to its market dominance.

Today, everything is still unknown. As foreign ministry spokesman Mao Ning said at a regular press conference on 6 November in response to a foreign media reporter's response to Trump's threat to raise tariffs on China, the U.S. presidential election is an internal affair of the United States, and we respect the choice of the American people. Regarding the tariffs you mentioned, we do not answer hypothetical questions. As for Trump's high tariff policy and the repeal of the Inflation Reduction Act and other ideas, both need to be passed through the U.S. Congress legislation, the Republican Party also has different voices within the Republican Party, even if Trump came to power, whether it can be advanced as envisaged there is still uncertainty.

Declaration: This article comes from the China Automotive News.If copyright issues are involved, please contact us to delete.