Following the German Continental Group on February 17 officially announced the launch of up to 7150 layoffs, another auto parts giant, formed by Faurecia and Hella FORVIA Group has also taken this step.

On February 19, local time, Feria Group announced the 2023 financial report, and in the financial report proposed to strengthen its European competitiveness in the 2024-2028 five-year plan, called "EU-Forward", one of the contents is that the company will cut up to 10,000 jobs in Europe in the next five years, including the layoffs of its subsidiary Hella. This will improve margins and address the new challenges posed by the electrification transition and regional competition in the automotive industry.

Photo credit: Automotive News Europe

01

Challenges in Europe

Formed by the merger of Faurecia and Hella in early 2022, the Freia Group now has about 157,000 employees worldwide and is one of the major suppliers of automotive parts such as car seats, interiors, electronic systems and lighting systems in the world, and was also the seventh largest auto parts giant in the world at the time. Later, due to the high performance of China's Ningde Times jumped to the fifth place, and in the top 100 global auto parts suppliers in 2023, Furia fell to the eighth place, which is followed by: Bosch, Denso, ZF, Magna, Ningde Times, Hyundai Mobis, and Aixin Precision.

The reason why the layoffs are focused on Europe is also because the core challenges facing Freya are currently in its European base camp. Car production in Europe has been recovering slowly in recent years, and consumer demand for relatively expensive electric vehicles has not been as strong as in China. In addition, the European economy is struggling, energy costs are rising, and the main engine manufacturers have cost reduction requirements for suppliers, and the European counterparts, Feria is also facing greater challenges.

"We are facing a downturn in the European market and we don't see any possible progress in the short or medium term. And we have many factories that are not operating at full capacity." Olivier Durand, Freya's chief financial officer, said at the day's earnings conference. The company revealed that it had overcapacity mainly in seats, interiors and some lighting products.

According to the financial report, in 2023, Furia's revenue was 27.248 billion euros, an increase of 11%. Operating profit was 1.439 billion euros, up 35.7% from the same period last year, which was an impressive increase. However, investors quickly discovered that the EMEA (Europe, Middle East and Africa) region, which includes the European home base, generated 12.65 billion euros in revenue, nearly half of the company's total revenue, but contributed only 20% of operating profit, just 316 million euros. In contrast, the Asian region generated 7.39 billion euros in revenue and 815 million euros in operating profit.

To this end, Frya has proposed an "EU-Forward" plan, one of which aims to cut costs by around 500 million euros per year from 2028. Patrick Kohler, chief executive, said the plan included adjusting regional production and research and development centres, staffing and R&D spending to keep pace with fundamental changes in the industry.

Over the next five years, Furia will reduce its European workforce, currently 75,500, by 13 per cent through job cuts, a hiring freeze and a reduction in short-term and temporary workers, in an effort to reduce overcapacity in Europe. "Our attrition rate is 2,000 to 2,500 people a year. In fact, the plan does not mean 10,000 job cuts. We need to make sure hiring is limited to what is absolutely necessary." "Durand said.

In addition to layoffs, Furia also plans to make large-scale use of AI technology to optimize R&D spending and improve global R&D and project management efficiency, so as to better compete with Asian rivals in the electrification transformation process. At the end of last year, Kohler revealed that with AI, the company hopes to halve its research and development costs by 2028.

In terms of performance, Freia expects its 2024 revenue to be 27.5 billion to 28.5 billion euros, with an operating margin of 5.6% to 6.4%. Specifically in Europe, Freia hopes to return its operating margin in the European region to its pre-pandemic level of 7%, compared with 2.5% in 2023. In addition, the "EU-Forward" plan will incur restructuring costs of about 1 billion euros.

02

Reduce dependence on China

It is worth noting that in the "EU-Forward" plan, Furia clearly proposes to "prepare for the evolution of the OEM landscape and the arrival of new players in Asia, and consolidate our strong position in Europe". It can be seen that, like the main engine factory, Feria is also vigilant about the expansion of Asian manufacturers in the European market.

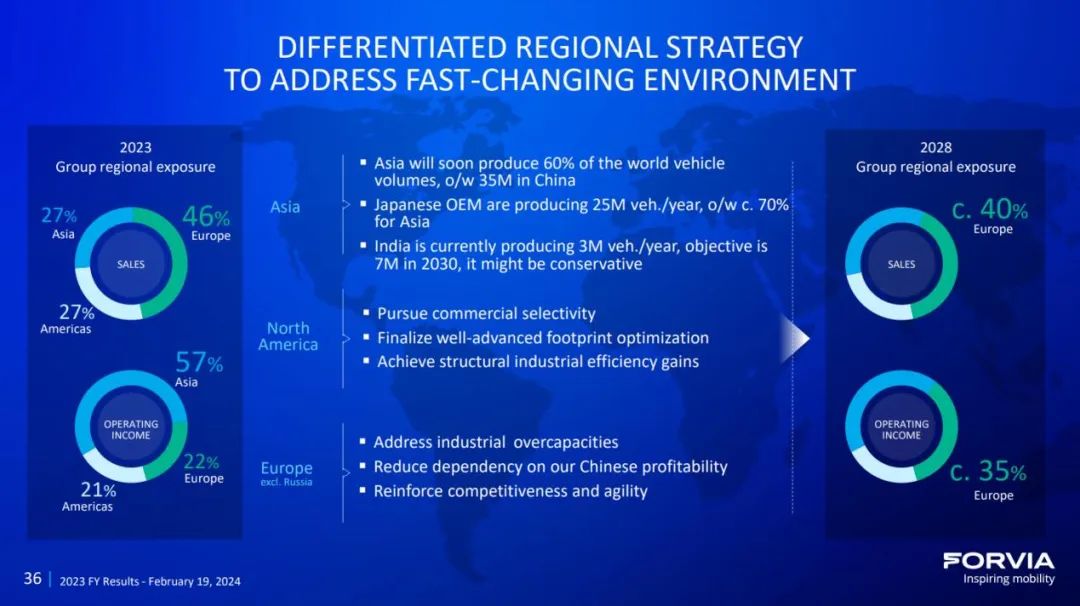

At the same time, Freya proposed to "rebalance Freya's regional performance - reducing dependence on China while increasing profitability in Asia". At present, the development of performance in the various regions of Freia is uneven. In 2023, for example, from the revenue point of view, Europe, the Americas and Asia accounted for about 46%, 27% and 27% respectively. However, in terms of operating profit, these regions accounted for 22%, 21% and 57%, respectively.

It can be seen that its Asian business is very visible, especially the growth of the business in China. In 2023, Freya China's revenue reached 5.85 billion euros, accounting for the largest share in the Asian region. According to Freya, 45% of the revenue in China comes from domestic manufacturers such as BYD and Ideal Automobile, and the other 55% comes from foreign manufacturers that have set up factories in China. In the seat business, Mr. Furia singled out Ideal Motors, BYD, "an American electric car manufacturer," and BMW. In the interior business, Feria specifically mentioned Changan Automobile and Ideal Car.

Freya is concerned about the high share of profits in Asia, especially China, so it hopes to reduce its dependence on the Chinese market by boosting its performance in Europe. Mr Furia aims to reduce Europe's share of revenues to 40 per cent by 2028 from 46 per cent in 2023, while increasing the region's share of operating profit to 35 per cent from 22 per cent in 2023.

In fact, as the automotive industry accelerates its shift to electrification and intelligence, mainstream automakers and parts suppliers around the world are recalibrating their strategies. On February 17, Continental announced that it would cut 7,150 jobs in order to improve its competitiveness in the electrification transition. At the same time, ZF, Bosch, Valeo and other parts manufacturers have recently launched layoff plans, with Germany as the representative of Europe to become the hardest hit area.

In addition, for the redundancy plan of Freya, there was no relevant news outflow before, which is quite surprising. However, from the birth of Freya has continued to "slim down", one after another to sell non-core business, it seems to be reasonable. In October 2023, Forea revealed in its third quarter earnings report that it had completed the €1 billion asset divestiture plan announced in April 2022, and at the same time launched an additional €1 billion asset divestiture plan to further reduce debt and financial expenses and accelerate deleveraging. Last year, the company closed its loss-making Highland Park, Mich., seating plant and laid off 511 workers.

Perhaps, the layoffs of Furia is not the end, as the industry turns, supplier strategy adjustment, there may be some manufacturers announced layoffs in the future.

Declaration: This article comes from the China Automotive News.If copyright issues are involved, please contact us to delete.